Child support laws play a crucial role in ensuring the well-being of children when parents separate or divorce. However, there is often confusion about the limits of child support obligations, particularly regarding the number of children involved. The question, "After how many kids no child support?" is a common one, and understanding the legal framework surrounding this topic is essential for both parents and guardians.

Parents often find themselves navigating complex legal systems when dealing with child support. The rules vary significantly depending on jurisdiction, but the underlying principles aim to protect the best interests of the child. In this article, we will explore the nuances of child support laws, focusing on the number of children and the potential limits of financial obligations.

By delving into the legal aspects, relevant case studies, and expert opinions, we aim to provide a comprehensive overview of the topic. Whether you are a parent seeking clarity or someone interested in family law, this article will offer valuable insights into the question of "after how many kids no child support."

Read also:Jeff Probst The Journey To Becoming Survivors Iconic Host

Table of Contents

- Understanding Child Support Basics

- The Legal Framework for Child Support

- How Number of Children Affects Child Support

- Income Caps and Child Support Limits

- State Laws and Variations

- Special Circumstances and Exceptions

- Enforcement of Child Support Orders

- Modifications to Child Support Orders

- Emancipation and Termination of Child Support

- Conclusion and Call to Action

Understanding Child Support Basics

Child support is a legal obligation imposed on parents to financially support their children after separation or divorce. This support ensures that children receive the necessary resources for their upbringing, including food, clothing, education, and healthcare. The primary goal of child support laws is to maintain the child's standard of living as close as possible to what it would have been if the parents had remained together.

The amount of child support is typically determined by a court order, based on factors such as the income of both parents, the number of children, and the custody arrangement. While the specifics vary by jurisdiction, the principle remains consistent: ensuring the child's welfare is paramount.

Who Pays Child Support?

Generally, the non-custodial parent (the parent with whom the child does not primarily reside) is responsible for paying child support to the custodial parent. However, in cases of joint custody, the parent with the higher income may be obligated to pay support to the other parent.

The Legal Framework for Child Support

The legal framework governing child support is established at both the federal and state levels in the United States. Federal laws set guidelines, while state laws provide more detailed regulations. This dual structure ensures consistency while allowing for regional variations.

Key federal laws include the Child Support Enforcement Act of 1984, which mandates the establishment of state child support enforcement programs. These programs assist parents in obtaining and enforcing child support orders.

State-Specific Regulations

Each state has its own set of regulations that dictate how child support is calculated and enforced. For example, some states use a percentage of income model, where the non-custodial parent pays a fixed percentage of their income, while others use an income shares model, which calculates support based on the combined income of both parents.

Read also:Velma And Daphne A Timeless Duo In Pop Culture

How Number of Children Affects Child Support

The number of children involved can significantly impact the amount of child support owed. Generally, the more children a parent has, the higher the total child support obligation. However, there are limits to how much a parent can be required to pay, depending on their income and other financial circumstances.

Key factors influencing child support based on the number of children:

- Each additional child increases the overall support obligation.

- The percentage of income allocated to child support may decrease slightly for each additional child to account for economies of scale.

- State laws may cap the total child support obligation, regardless of the number of children.

Examples of Child Support Calculations

Consider a scenario where a parent has three children. Under an income shares model, the court may calculate the total cost of raising three children and then divide that cost proportionally based on each parent's income. If the non-custodial parent earns $50,000 annually and the custodial parent earns $30,000, the non-custodial parent might be responsible for 62.5% of the total child support obligation.

Income Caps and Child Support Limits

While child support obligations are based on a parent's income, there are often caps or limits to prevent excessive financial burdens. These caps vary by state but generally aim to balance the needs of the children with the financial capabilities of the paying parent.

Income caps are typically determined by:

- The state's median income levels.

- The number of children involved.

- Other financial obligations of the paying parent, such as spousal support or debts.

What Happens When Income Caps Are Reached?

If a parent's income exceeds the cap, the court may still order additional support based on the specific needs of the children. For example, if a child has special medical or educational needs, the court may exceed the cap to ensure those needs are met.

State Laws and Variations

State laws play a significant role in determining child support obligations. While federal guidelines provide a framework, each state has its own rules regarding how child support is calculated and enforced. For instance, some states have more stringent enforcement mechanisms, while others offer more flexibility in modifying support orders.

Examples of state variations:

- In California, child support is calculated using a complex formula that considers both parents' incomes and time-sharing arrangements.

- In Texas, child support is based on a percentage of the paying parent's net resources, with a cap of $15,000 per month.

Impact of State Laws on Parents

Parents must be aware of the specific laws in their state, as these laws can significantly impact their financial obligations. Consulting with a family law attorney is often advisable to ensure compliance and protect one's rights.

Special Circumstances and Exceptions

There are certain circumstances where child support obligations may be modified or terminated. These exceptions are typically based on the unique needs of the children or the financial situation of the parents.

Common special circumstances include:

- Children with disabilities who require ongoing support beyond the age of majority.

- Parents who experience significant changes in income or employment status.

- Children who are emancipated or become self-sufficient before reaching the age of majority.

How to Request a Modification

To request a modification of a child support order, parents must file a petition with the court. The petition should include evidence of the changed circumstances and a proposed new support amount. The court will review the request and make a determination based on the best interests of the child.

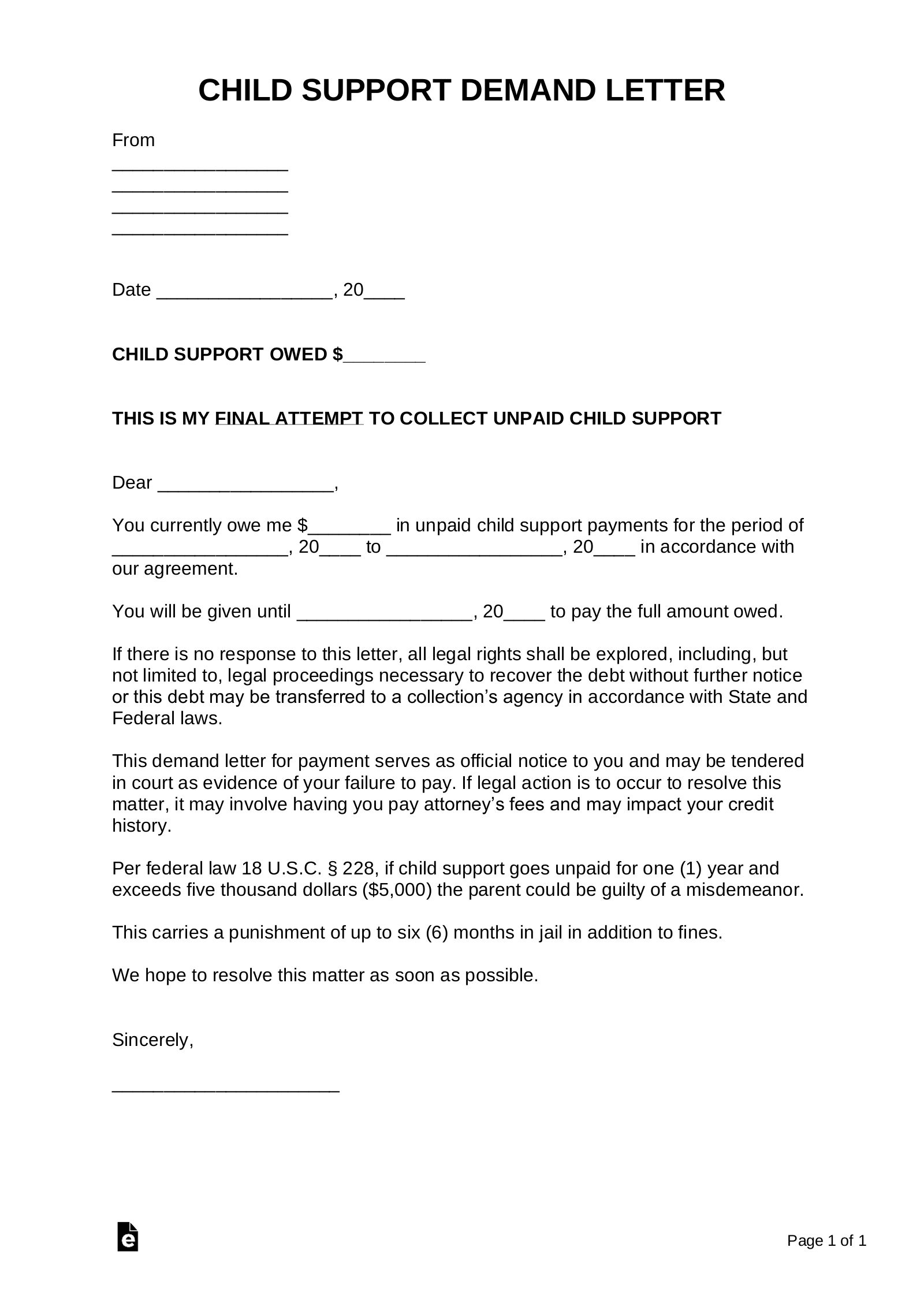

Enforcement of Child Support Orders

Enforcing child support orders is critical to ensuring that children receive the financial support they are entitled to. States have various mechanisms in place to enforce these orders, including wage garnishment, liens on property, and even suspension of driver's licenses for non-compliance.

Enforcement methods may include:

- Income withholding orders that automatically deduct child support payments from the paying parent's paycheck.

- State and federal tax refund intercept programs that seize tax refunds to satisfy past-due child support.

- Legal action against parents who intentionally avoid their child support obligations.

Consequences of Non-Payment

Failure to pay child support can result in severe consequences, including fines, jail time, and damage to credit scores. Parents who are struggling to meet their obligations should seek legal assistance to explore modification options rather than risk non-compliance.

Modifications to Child Support Orders

Child support orders are not set in stone and can be modified if there is a substantial change in circumstances. This flexibility allows for adjustments as the needs of the children or the financial situation of the parents change over time.

Grounds for modification may include:

- Significant changes in income or employment status.

- Changes in custody arrangements or visitation schedules.

- Medical or educational expenses for the children.

The Modification Process

Parents seeking to modify a child support order must file a motion with the court that issued the original order. The court will review the request and may require a hearing to determine whether a modification is warranted. It is important to note that modifications are only effective going forward and do not retroactively alter past-due support obligations.

Emancipation and Termination of Child Support

Child support obligations typically end when a child reaches the age of majority or becomes emancipated. Emancipation occurs when a child becomes self-sufficient and no longer requires parental support. The age of majority varies by state but is generally between 18 and 21 years old.

Scenarios that may lead to emancipation:

- The child graduates from high school.

- The child marries or joins the military.

- The child becomes financially independent.

What Happens After Emancipation?

Once a child is emancipated, the paying parent's obligation to provide child support for that child typically ends. However, if there are other children still dependent on the support, the obligation may continue for those children. Additionally, support for children with disabilities may continue indefinitely if deemed necessary by the court.

Conclusion and Call to Action

In conclusion, the question of "after how many kids no child support" is complex and depends on various factors, including state laws, income caps, and special circumstances. Understanding the legal framework surrounding child support is essential for parents navigating these issues. By staying informed and seeking legal advice when needed, parents can ensure they meet their obligations while protecting their rights.

We encourage readers to share this article with others who may benefit from the information provided. For those with specific questions about their child support obligations, consulting with a qualified family law attorney is highly recommended. Additionally, explore our other resources on family law and child support for further insights.

![Free Child Support Agreement Templates [PDF, Word] Without Court](https://www.typecalendar.com/wp-content/uploads/2023/05/child-support-agreement-between-parents.jpg)

![Free Child Support Agreement Templates [PDF, Word] Without Court](https://www.typecalendar.com/wp-content/uploads/2023/05/will-a-notarized-child-support-agreement-hold-up-in-court.jpg?gid=89)